"Money market funds" invest largely in cash and short-term debt instruments. They are considered one of the safest financing options since they deliver a consistent stream of tax-free or regular income tax-rate income, depending upon this fund's underlying investments. Money markets' high liquidity allows investors to manage cash and short-term holdings. Your account information, including APY.

All You Need To Know About Money Market

Who Should Put Money Into Them?

Investors with a limited risk tolerance who are only wanting to park their money for something like a short time can consider money market funds. These funds are suitable for those with spare cash and a target date of up to a year. These investments may provide returns that are slightly better than those offered by a standard savings account.

Is This Money Safe?

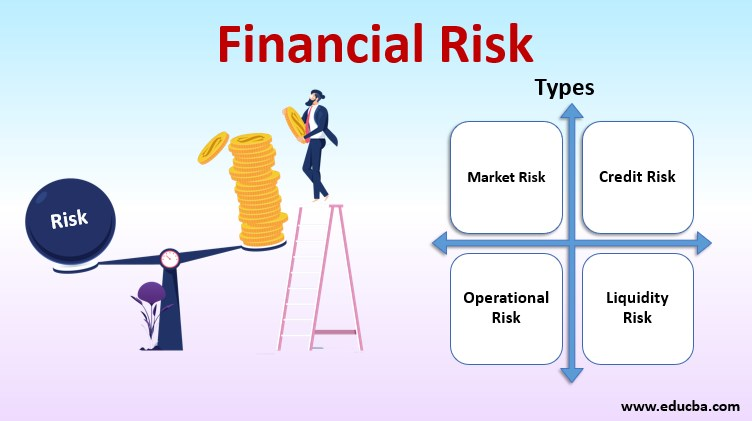

The dangers of money market funds include mortgage rate threat and credit risk, just like any other debt fund. However, due to their focus on investing in short-term debt instruments, these mutual funds are less risky than those that deal in longer-term debt.

How Much Profit Can You Expect?

An investment in a money market fund may yield better returns than a traditional savings account. However, their returns can fluctuate and sometimes be lower. As an illustration, Value Research reports that money market funds as a whole have returned 3.35 percent annually. The returns from these funds are higher than those from medium-duration funds, long-duration funds, and dynamic bond funds. Although safer from default risk funds, limited term funds, and liquid funds, these investments offer lesser returns. Most people would suffer financially if interest rates were to increase.

Money Market Benefits

Stability

One of the most stable categories of mutual funds is the money market fund.

Liquidity

Assets in a money - market fund or brokerage account are often available for withdrawal the following business day, making it simple to settle stock or bond trades.

Security

Federal restrictions mandate that the funds put their money into low-risk, short-term assets, making them more resilient to market swings than other investment vehicles.

Short time frame

Mutual fund funds often have lower interest risk than investments in longer-maturity bond funds due to their short duration (typically a few months or less).

Diversification

Many mutual funds funds contain a wide variety of securities but have little exposure to foreign markets. Financed by the Treasury, any one issuer

Possible tax benefits

When it comes to federal and sometimes state income taxes, interest payments from certain securities that are invested in by money market funds are normally excluded. This means that these funds can provide a reliable, tax-efficient source of income.

Money Market Fund Risks

Credit risk

Money market mutual funds, in contrast to traditional bank CDs or savings accounts, are not insured by a Federal Deposit Insurance Corp. (FDIC); although multi - cap funds invest in high-quality financial products and aim to safeguard the value of the stock, there is also the risk that you could fall in value, and there is neither confirmation that you will receive $1 per equity when redeeming your investment.

Inflation risk

Exchange traded fund returns are often lower than those of other volatile investment like standard bond and equity investment options, increasing the risk that the rate of profit may not keep up with inflation due to the safe operation and quick character of the underlying investments.

Prime investment funds

Foreign Exposure

Negative political, regulatory, commercial, or economic changes in a foreign country could have an impact on a company with a foreign location countries.

Financial Services Exposure

The price of financial services sector securities and the ability of issuers in the sector to meet payment obligations can be negatively impacted by changes in government regulation, interest rates, and economic turmoil.

All Municipal and Premier Money Market Funds

Liquidity risk

If the fund's liquidity falls below statutory minimums due to market developments or other factors, the fund may assess a fee only upon sale of your shares or severely restrict your option to sell shares.

Institutional Prime and Municipal Money Market Mutual Funds

Price risk

Due to the ebb and flow of the fund's share price, the amount you receive when selling your shares may be higher or lower than what you paid for them.

Conclusion

Debt funds with maturities of less than one year are known as money market funds. The money market is the primary exchange for the issuance and trading of short-term assets known as money market securities.