Because of the important part that the financial bank stocks today sector plays in the Overall Economy as a whole, the banking industry is commonly recognised as one of the most significant actors in the global economy. This is due to the fact that the banking industry is responsible for a major portion of the overall economy. Consideration should be given by investors to the possibility of enhanced returns via the acquisition of list of bank stocks, which is an attractive investment choice. The financial health of a bank is said to be in the finest condition when it belongs to an organisation that has demonstrated that it is robust and dependable and that it has opportunity for future expansion. Consequently, the opportunities presented by these stocks to investors are very exciting.

A Comprehensive Understanding

It is essential to have a strong understanding of the dynamics of the banking business in order to have a firm grip on the prospects given by bank stocks. This awareness may be gained by reading about the banking industry. As a result of their role as middlemen, banks are in the enviable position of being able to not only facilitate the movement of capital but also provide the funding that is essential for economic overall economy activities. The following activities bring in revenue for the business: lending, which results in the accumulation of interest income; fee-based services; and investing operations. The power of a bank is determined by a number of distinct aspects, including the composition of its holdings, the volume of capital it owns, the profitability of its banking operations, and the dexterity with which it navigates the inherent risks associated with its line of work.

When Evaluating the Value of Bank Stocks

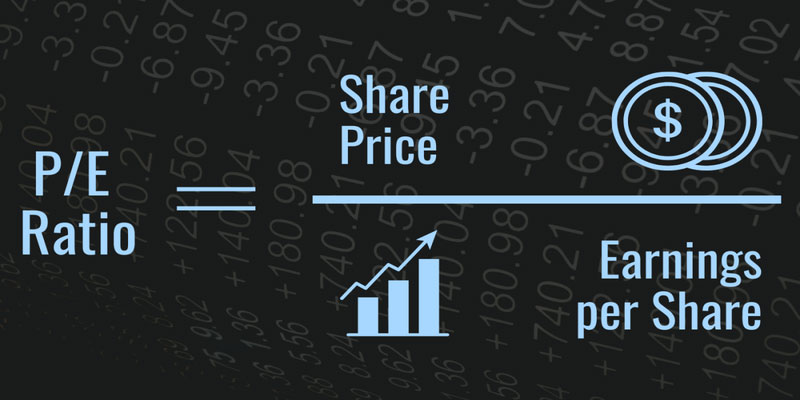

Before investing your money in a Bank's Financial Health, you need to take into account the numerous factors that influence the performance of the stock in the present day. Take into account the points that are listed below. Analysing the Short-Term and Long-Term Financial Performance of The Banking Business There are three indicators that may be taken from the financial records of a financial institution to provide insight into the institution's health as well as its performance over time. These metrics include revenue growth, profitability, and return on equity (ROE).

Environment with Regard to Regulations: The existing regulatory frameworks for the economy as a whole have a significant impact on the direction that the banking sector will take in the future. It is necessary to verify that a bank complies with the regulations governing the banking company and that it is able to bank stocks to buy adapt to the ever-changing regulatory requirements.

Quality of the Assets

In order to gain insight into a bank's ability to manage credit risk and maintain asset quality, it is helpful to conduct an analysis of the bank's loan portfolio, as well as its credit quality and provisions for bad loans. Examining the bank's provisions for poor loans as well as the institution's credit quality is one way to attain this goal.

Capital Adequacy: Adequate capital defends a bank against future losses. Evaluating a bank's capacity to obtain capital as well as the bank's ratio of adequate capital is an absolute requirement. When conducting an analysis of the potential and long-term viability of a financial institution, it is beneficial to take into consideration the institution's market share, client base, geographic diversification, and competitive advantage. Presence in the Market When investing in expansion bank stocks, it is important to consider both the short-term and long-term prospects of the financial institution.

Stocks of Leading Financial Institutions to Keep an Eye On

JPMorgan Chase & Co. (JPM) is a multinational financial services corporation that is well-known for its great financial performance, rigors risk management, and several sources of revenue. JPMorgan Chase is a formidable competitor in both the retail and institutional banking sectors. It has a track record of providing its shareholders with satisfactory returns and is consistently listed among the top financial institutions in the world. In addition to this, it has repeatedly been ranked as one of the top financial institutions in the entire world.

Bank of America, Inc. (also known as BAC): Bank of America is a significant financial organisation in the United States, and it provides customers with a comprehensive range of banking services in addition to other associated options. For want of a better phrase, Bank of America is the owner of Bank of America. It has demonstrated its durability and adaptability by placing a high priority on technical innovation, cost control, and programming that are centred on the consumer. Because of the company's robust financial position and the diversity of the revenue streams it generates, Bank of America is an attractive investment prospect.

Services of International Banks and Financial Institutions

HSBC Holdings plc, also known simply as HSBC, is a worldwide organisation that provides financial services including banking. It is in an excellent position to capitalise on growth opportunities in emerging regions, where it already has a large footprint, and where it is well-positioned to do so. HSBC is an enticing choice for investors who are interested in entering global markets as a result of the bank's focus on digital transformation, risk management, and cost efficiency.

WFC, which stands for Wells Fargo & Company. Wells Fargo is widely recognised as the most successful financial services corporation in the United States.

This is partly because to the breadth and depth of its product and branch distribution networks. In spite of the difficulties it has had over the past few years, Wells Fargo is taking substantial steps to reform itself in order to improve its operational efficiency and win back the faith of its investors. Because of its affordable price and the positive prospects for its continued expansion, it is a business that should be taken into consideration.

Possible Threats and Essential Things to Take into Account

It is crucial for investors to be aware of the risks that are inherent in the banking sector, despite the fact that bank stocks have a lot of appeal. There are a variety of factors, including economic downturns, changes in interest rates, new regulatory requirements, and credit risks, that have the potential to affect the performance of bank stocks. Investing strategies that include substantial amounts of study and diversity of portfolios